VA Mortgage

The VA Loan is made for veterans, military members currently serving in the U.S. military, reservists, and surviving spouses. It can be used to buy single-family homes, condominiums, multi-unit properties, manufactured homes, and new construction. Simply put, it’s a benefit for the veterans, it’s a mortgage. The most [...]

VA Jumbo

But what if you're purchasing something larger? The VA Jumbo is basically a VA Mortgage with a loan amount over the lending limit in your area, BUT as of January 1, 2020 there is only 1 different between a regular VA loan and a VA Jumbo loan, the rate. [...]

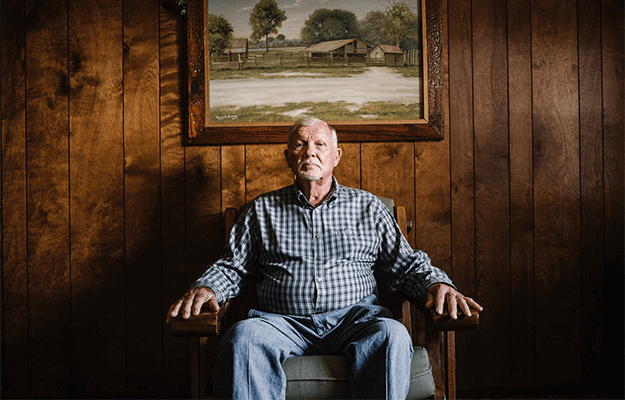

Reverse Mortgage Loan

The FHA reverse mortgage is a mortgage loan available to homeowners, 62 years or older, that allows them to convert part of the equity in their homes into cash. This is done by taking any combination of lump sum, monthly payments, and/or line of credit, but the amount and [...]

Jumbo Reverse Mortgages

In 2017, the FHA Reverse Mortgage or HECM (click here to learn about the HECM) became less attractive to borrowers, and there was worry the “viability” of the HECM was in jeopardy. So the largest reverse mortgage lenders began create their own versions of the reverse mortgage. Previously there [...]

Jumbo Mortgage

Whether your county lending limit is $510,400 or $765,600, if you go above that limit, you are not longer in the realm of the conventional mortgage. There are High-Balance Mortgage Loans, which are not as large or as strict as Jumbo Mortgage Loans. Jumbo can be in the millions and [...]

High Balance

Whether your county lending limit is $510,400 or $765,600, if you go above that limit, you are not longer in the realm of the conventional mortgage. There are High-Balance Mortgage Loans, which are not as large or as strict as Jumbo Mortgage Loans. Jumbo can be in the millions and [...]